The IPD Botswana Property Performance Report for the year ending December 2011 reveals significant findings about the real estate market in Botswana. This comprehensive report provides valuable insights into property investment trends, total returns, income yields, and capital growth in the country. This article delves into the key highlights of the report, shedding light on the performance of different property sectors and the implications for investors in Botswana.

Total Return Analysis:

The IPD Botswana Property Performance Report indicates a total return of 20.9% for the year, comprising an income return of 10.8% and capital growth of 9.2%. Notably, the report highlights the stability of growth in nominal terms, considering that headline inflation in Botswana during the same period was also 9.2%. This underscores the importance of income yields in the property market and their impact on overall returns.

Sector Performance:

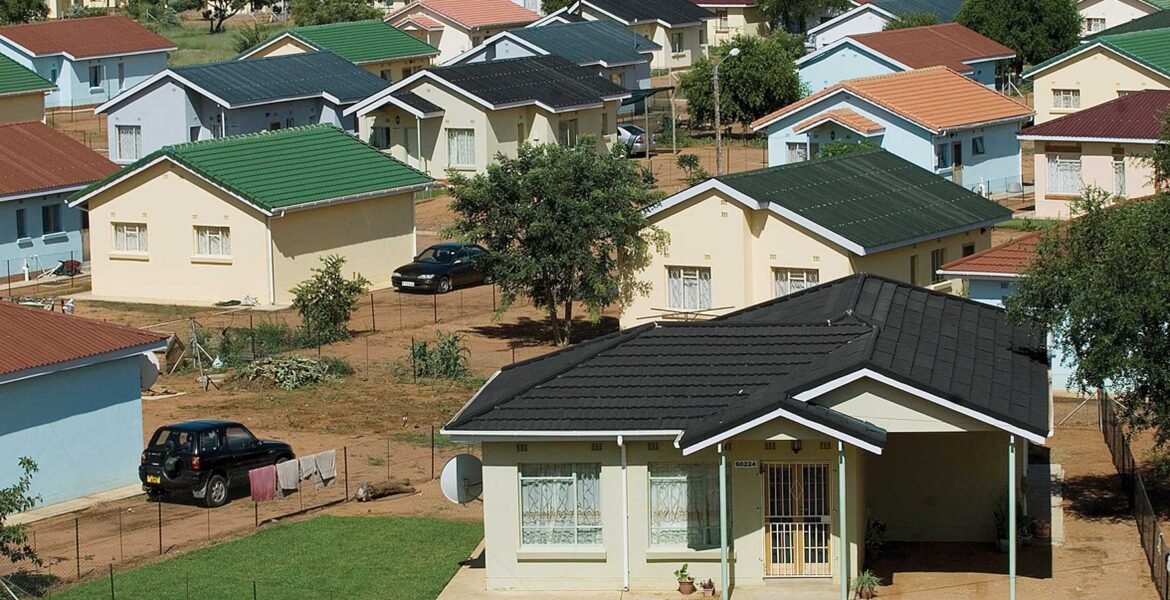

Retail and residential property investments outperformed offices, reflecting recent development activities in the office sector and the resulting pressure on rental levels. The report provides a detailed analysis of the performance of different property sectors, offering valuable insights for investors looking to diversify their portfolios in Botswana.

Industry Collaboration and Transparency:

The IPD Botswana Property Performance Report is a result of collaboration between IPD SA and key partners in Botswana, including leading property investment portfolios and industry associations. The involvement of industry stakeholders and the government’s support of the initiative underscore the commitment to promoting transparency and providing reliable data for the property market.

Market Expansion and Investment Opportunities:

The launch of the IPD Botswana Property Performance Report marks a significant milestone for the Botswana property market, opening up new opportunities for local and global investors. The report serves as a valuable tool for stakeholders, offering comparative, accurate, and timely data to support informed decision-making in property investment and management processes.

Advancing Data-Driven Decision-Making:

By offering objective performance reports, the IPD Botswana Property Performance Report enhances asset and portfolio risk management, facilitates cost reduction, and improves efficiency in property investments. The availability of credible data and research over time enables investors and managers to adopt a disciplined approach to property investment, ultimately enhancing the overall performance of properties in Botswana.

Conclusion:

The IPD Botswana Property Performance Report provides a comprehensive overview of the real estate market in Botswana, offering valuable insights into total returns, income yields, and sector performance. This report not only enhances transparency and data availability but also serves as a catalyst for informed decision-making and strategic investments in the Botswana property sector. As Botswana continues to attract investors and expand its property market, the IPD report plays a crucial role in shaping the future of real estate investments in the country.